While progress has been made in recent years in taking action to support EFW, there has been less focus on assessing needs and then evaluating effectiveness. It is important that you also focus on these key stages to ensure your activity in this area meets the needs of your employees and has maximum impact. Assessing employee needs helps to identify which employee groups are experiencing financial distress and are in most need of support or those who are at most risk. Rather than making assumptions about what employees need, it is vital to engage with your employees and proactively identify issues that may affect different employees.

How can I identify an employee who is struggling financially?

Changes in employee behaviours, such as higher absence, lower productivity, presenteeism, lower-quality work, changes in mood, more distraction or less focus and attention to detail, increased overtime working, or delayed retirement plans may all be indicators of financial difficulties. You should ensure HR and managers know how to spot the physical, psychological and behavioural signs of poor mental health. Normalising conversations about money in the workplace may encourage employees to feel more comfortable about raising their concerns – by leaders openly discussing these issues, for example.

Consider the characteristics of your workforce

Poor financial wellbeing can be difficult to identify, and all employees can experience it – it is not only low-paid, junior or lower-skilled employees who are at risk. Many senior employees also face financial challenges.* In addition, the risks vary depending on sector, hourly pay and hours worked, geography, age, gender, ethnicity and disability. Some of the most vulnerable to in-work poverty are:

- those not working full-time

- single-parent families

- people living in rented accommodation

- families who have a member with a disability

- families with three or more children or households headed by someone from an ethnic minority group.

* CIPD roundtables held to inform the 2022 Reward management survey cited examples of senior employees getting into financial difficulties due to life events such as illness, bereavement, or divorce/separation. In addition, a survey from Salary Finance (2019) found that the employee groups with the highest level of financial worries were those earning less than £10k per annum, between £10k and £15k per annum, and those earning more than £100k per annum (cited in Alliance Manchester Business School. (2020) National Forum for Health & Wellbeing at Work: Financial Wellbeing Guide. The University of Manchester, February).

Because of this, there can be no one-size-fits-all approach to supporting employee financial wellbeing, as certain employee groups and people at different life stages may benefit from different types of support.

Therefore, before any support interventions are rolled out, you should determine your workforce’s specific support needs, based on information and data rather than assumptions.

You may find it helpful to consider the characteristics of your workforce and split your employees into groups to better understand their likely financial challenges, especially in the current economic context. In addition, you should be mindful of any future workforce demographics in any assessment of need, especially if your organisation is embarking on change.

While not all employees in the characteristic groups will face the same challenges, it is a helpful starting point. Useful segmentation could include:

- people starting their first job or apprenticeship, whose challenges could include their ability to understand and effectively use personal finance skills, substantial student loans or credit card debt, limited affordable housing and navigating future financial goals

- people dealing with increasing day-to-day financial pressures while balancing the demands and costs of family life with the need to save more to buy a house or have enough for retirement

- people needing to maximise their retirement fund, potentially with responsibilities for older people, or developing ill health themselves

- socio-demographic factors: some smaller employers may have knowledge of the circumstances of their employees that may place them in higher-risk categories for poor financial wellbeing – for example, lone parents, carers and social housing tenants.

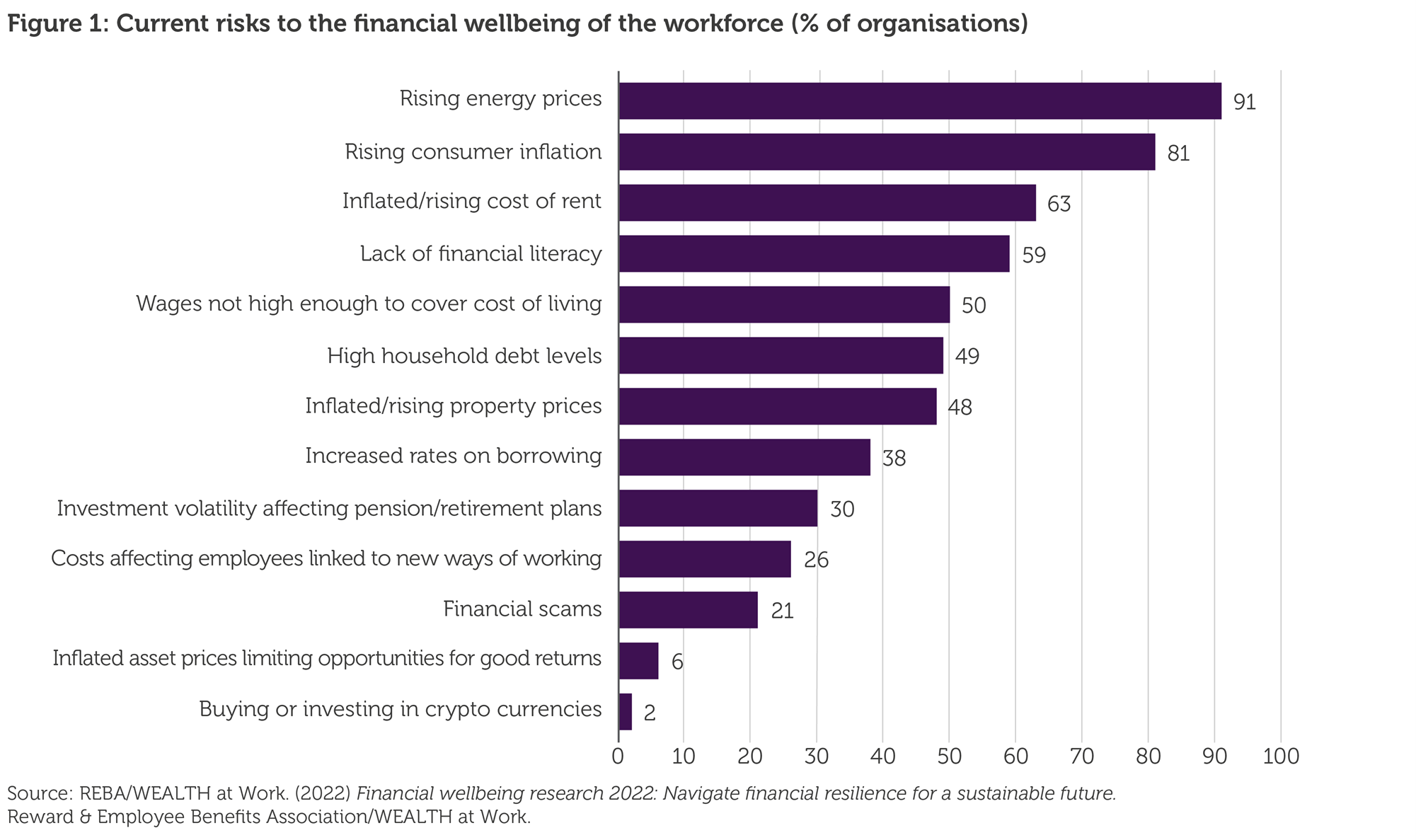

"More than half (59%) of employers identified poor financial literacy as a major financial wellbeing risk across all generations."

REBA, 2022

Collate relevant information

A significant challenge to effectively supporting EFW is having enough information about employees’ financial circumstances to understand their needs. More than a third (35%) of organisations do not currently measure any aspect of employee financial wellbeing, and two-thirds of organisations state they do not have the data to understand their employees’ financial challenges, increasing the risk that any interventions will have little or no impact.

This lack of data may be partly due to the stigma that remains surrounding money issues and reluctance to disclose information about personal finances (although these reservations appear to be lessening in the current crisis). However, research by the CIPD found that only 20% of organisations actually ask their employees about their financial wellbeing at least once a year. In addition, only 10% of employees state that their employer has asked them if they would like support with their financial wellbeing.

A bespoke anonymised employee survey is generally the best tool to determine employees’ financial wellbeing needs and help to identify particular issues that are causing financial distress. See an example of this approach in our NHS West London case study.

If not enough data is available and a survey isn’t an option, you may be able to use existing sources of employee information to gain insights (ensuring GDPR requirements are met), for example:

- A simple analysis of your workforce demographic (for example, age, gender, income levels, culture and location) may help to inform the potential nature of any financial worries.

- Publicly available sectoral research may provide relevant industry data.

- Looking at data in your HR system (data on age, salary level, employment status, bonus payouts, use of maternity/paternity/adoption leave) may provide clues for offering timely support to employees.

- The outcomes of equal pay audits, gender or pensions gap analyses may highlight any disadvantaged groups.

- Absence (related to stress or anxiety) data and/or disciplinary case data (related to performance issues, lateness, or even theft/fraud) may indicate poor financial wellbeing or in-work poverty.

- Your payroll department may be able to share information about the nature of employee queries they receive.

- Your employee assistance programme provider and existing providers of any financial benefits may be able to provide insights linked to the take-up of relevant support; for example, a low take-up of benefits such as pensions and saving schemes may indicate low levels of financial understanding or inadequate pay levels, and any increase in the take-up of pay advances or hardship loans may indicate financial distress.

- Managers may be able to offer anonymised insights into their experiences with employees related to money issues; however, to preserve the environment of trust, ensure no personal information is shared.

- Similarly, trade unions may have data on the financial wellbeing of their members.

- Existing employee attitude or engagement surveys may also provide some clues about the current state of employee financial wellbeing in areas such as current levels of satisfaction, work-related stress, views on pay and benefits, and quality of management.

In terms of sources of new information on EFW, you could also set up focus groups to identify useful services and engage with employee representatives/networks.

Bespoke employee surveys

The CIPD report Financial wellbeing: An evidence review provides some validated and reliable measures of financial wellbeing to include in staff surveys. In addition, we include some sample questions in the Appendix 2 that may help to gain insights into your employees’ current financial wellbeing.

It is important to ensure employees understand why an employee survey is being conducted and to reiterate that responses will be anonymous and treated confidentially. Collaborating with your internal communications team could help to simplify the messaging. Having a champion at a senior level within the organisation may encourage participation. A summary of the findings should be shared with employees, alongside a commitment to help address any needs identified. These actions will help to foster trust and engagement in the process and may help to open dialogue between managers and employees on EFW, opening up the culture to these types of discussions.

Collecting baseline data before implementing any interventions also enables their impact to be evaluated (Stage 5 of this guide) and will help determine the return on investment of initiatives.

Map existing EFW support

In addition to the assessment of employee need, you should assess what is already in place within your workplace to support financial wellbeing. As well as helping to evaluate the effectiveness of any existing actions, this analysis will help to identify gaps in support, for which there may be employee demand, and areas for improvement. Beyond any existing financial wellbeing initiatives, you may want to include your current rewards and benefits policies in the analysis.

|

Key considerations to help you assess your need for EFW support

Current provision

- What initiatives do we currently offer linked to employees’ financial wellbeing; for example, pre-retirement and financial literacy classes, discount and savings schemes, debt support, mental health support, and so on.

- How well do we communicate these so that the benefits are understood by our different employee groups?

- What elements of the reward package offer the best value for money and which elements are delivering less value?

- Is there enough choice and flexibility for staff to tailor their reward package to suit their own personal circumstances and financial goals?

- Do we have open communication channels with employees at every level of the organisation to support our wellbeing message?

- Where would employees typically turn internally to look for help if they are in financial difficulty?

Existing data

- How many requests are we receiving for emergency loans, or earned wage access?

- What feedback do we have from our employee assistance programme (EAP) provider regarding frequency/volume of money queries and problems?

- What are our levels of absenteeism/presenteeism and how do these vary across the main employee groups and levels?

Potential gaps

- Do we know what our employees think about the current reward package?

- Do our employees think that we are supporting their financial wellbeing? And how well? How does this vary between different categories of employees; for example, younger compared with older workers?

- What do our external stakeholders – investors, customers – expect us to deliver in this area?

- What level of financial knowledge do our employees have?

- How committed are our employees at present and how do engagement levels vary across the main employee groups and levels?

|

|