Labour Market Outlook

A forward-looking indicator of the UK labour market with unique insight on labour market topics

A forward-looking indicator of the UK labour market with unique insight on labour market topics

The CIPD’s Labour Market Outlook is a forward-looking indicator of the UK labour market. It is a quarterly survey of 2,000+ employers, providing analysis on recruitment, redundancy and pay intentions combined with unique insights on labour market topics.

The LMO is published every February, May, August and November. Its insights feed into our consultations and engagement with UK Government and policy-makers.

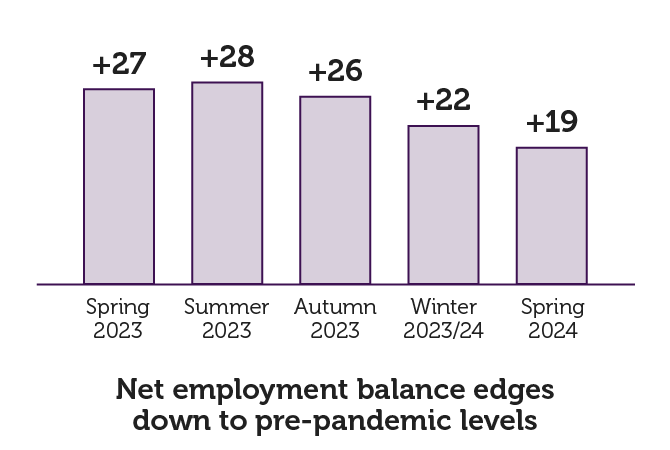

In this quarter, the big picture shows that despite the labour market reverting to somewhat of a post-COVID normality, there continues to be a high level of vacancies by historic standards. Our data reveals a cross-sector fall in the net employment balance (our main barometer for employment intentions). The overall score remains well above zero but has continued on a downward trajectory. There could be further falls in both turnover and therefore vacancy levels in 2024 based on this trend.

Expected pay awards for the next 12 months remain unchanged on last quarter. The gap between public and private pay awards persists. Currently, the rate of inflation, which has fallen to a healthier 3.2%, sits between these two figures. This discrepancy means it may become more difficult to retain public sector staff in the coming months.

Read on for our latest labour market data and analysis on employers’ recruitment, redundancy and pay intentions this spring.

|

Net employment balance edges down to pre-pandemic levelsThe net employment balance – which measures the difference between employers expecting to increase staff levels in the next three months and those expecting to decrease staff levels – remains positive but has continued its downward path from +22 last quarter to +19 this quarter. |

|

More employers keeping staff level steadyOver half (55%) of employers are looking to maintain their current staff level. This is the highest proportion since winter 2016/17. |

|

Public sector employers twice as likely to reduce staff levelsPublic sector employers are twice as likely as their private sector counterparts to decrease their total staff level in the next three months (19% v 9%). |

|

Hard-to-fill vacancies remain prevalentThirty-seven per cent of employers surveyed have hard-to-fill vacancies. Hard-to-fill vacancies are significantly higher in the public sector (52%) than the private sector (33%). |

|

Expected pay awards higher in private sectorThe median expected basic pay increase remains at 4% for the second consecutive quarter. Expected pay awards in the next 12 months are lower in the public sector (3%) compared with the private sector (4%). |

Are you a journalist looking for expert commentary and insights on the world of work?

Browse our A–Z catalogue of information, guidance and resources covering all aspects of people practice.

Our Labour Market Outlook survey findings play an important role in shaping our content and communications on a wide range of topics and focus areas at the CIPD. Our survey findings achieve this by providing labour market insights that support broader discussions on topics including staff morale, pay transparency, generative AI and financial wellbeing.

CIPD research shows varied responses to generative AI use from organisations, as some explore opportunities to improve productivity

Charles Cotton addresses the question of what constitutes a reasonable National Living Wage, by analysing the CIPD Labour Market Outlook – Summer 2023 report

A Northern Ireland summary of the CIPD Good Work Index 2024 survey report

A North of England summary of the CIPD Good Work Index 2024 survey report

The CIPD Good Work Index provides an annual snapshot of job quality in the UK, giving insight to drive improvement to working lives