Paternity leave and unpaid parental leave: Changes under the Employment Rights Act 2025

Access the guidance and resources you need to meet the new paternity and unpaid parental leave requirements under the Employment Rights Act 2025

CIPD pay and reward adviser Charles Cotton examines how potential changes to pensions in the UK could affect employers, and what the implications could be for those in HR

Employee reward is a significant investment for organisations. Not only is it the largest employment cost, it’s also the most significant business expense for many workplaces. It’s also a part of workplace finances that is of significant interest for the UK Government. Consequently, the government has been reviewing how workplace pension management and investments could deliver better results.

The government’s Pension Bill proposes that pension schemes carry out value for money reviews, introduces flexibilities for Defined Benefit pension schemes in terms of surpluses, and facilitates the consolidation of small employee pension pots. The government also wants to foster the creation of collective defined contribution pension schemes. The aim of this activity is to increase the likelihood of good outcomes for both employees and employers.

In addition, in July 2025, the government announced the re-establishment of the Pensions Commission to review workplace pension adequacy. Since automatic enrolment was introduced, it means more workers are saving for retirement, but there are still concerns that what’s being saved won’t be enough to deliver an adequate retirement for many. But how can contributions be increased?

Legislative changes under the Pensions (Extension of Automatic Enrolment) Act 2023 empower the Secretary of State to lower the enrolment age from 22 to 18 and remove or reduce the Lower Level of Qualifying Earnings (LLQE). Reducing the age allows workers to start saving earlier, while abolishing the LLQE (currently £6240) would increase pensionable pay. For example, removing the LLQE for a £20,000 earner raises qualifying earnings from £13,760 to £20,000, increasing both employer and employee contributions.

In September 2025 the CIPD conducted a survey which asked questions on some ways pension contributions could be increased, asking over 2000 senior decision-makers with responsibility in their organisations for employment decisions, such as reward, recruitment, training and other areas.

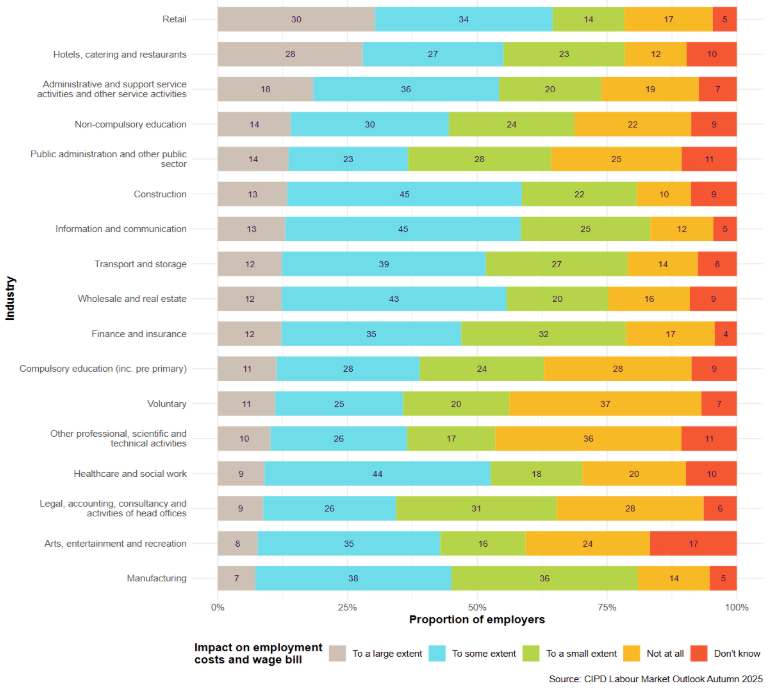

When we asked respondents how lowering the minimum enrolment age would increase their organisation’s employment costs, 14% said it would by a large extent, 35% to some extent, and 23% to a small extent. A further 20% said there would be no impact.

Figure 1 shows many employers in retail, and hotels, catering and restaurants, would see their employment costs rise significantly, reflecting the higher numbers of young workers they employ.

Figure 1: Potential impact on employment costs and wage bill of reducing automatic enrolment pension age from 22 to 18

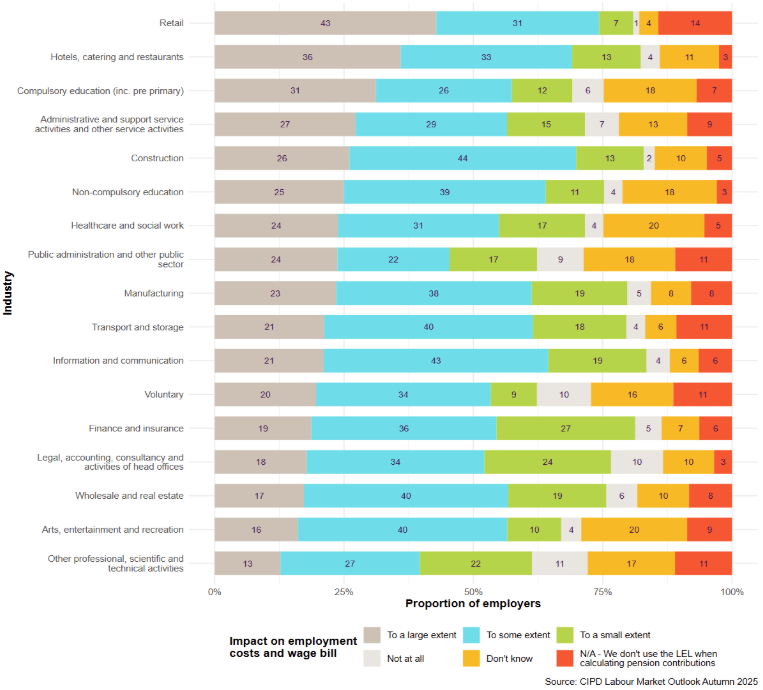

In terms of scrapping the LLQE when calculating employer pension contributions, respondents were asked how this would increase employment costs. 24% said it would increase them to a large extent, 34% to some extent and 16% to a small extent.

Figure 2 again shows that retail and hotels, catering and restaurants firms would be hit hard by this move.

Figure 2: Potential impact on employment costs and wage bill of removing lower earnings limit

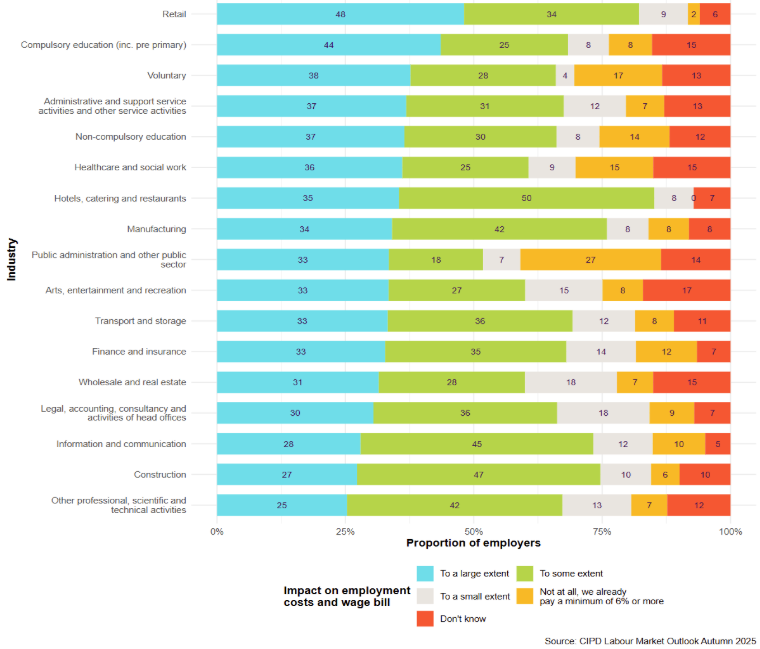

The amount going into workplace pensions can also be increased by raising contributions from a minimum of 8% to 12% of pay, with at least 6% coming from employers. When asked how this would increase their organisations’ labour costs if it was phased in over three years, 35% said to a large extent, 33% to some extent and 11% to a small extent.

Figure 3 shows that many employers in the retail, compulsory education and voluntary sectors would be hard hit.

Figure 3: Potential impact on employment costs and wage bill of increasing the minimum auto enrolment contribution from 8% to 12%, with the minimum employer contribution going up from 3% to 6% over a three-year period

We also asked if requiring employers to include pension contribution rates in all their job adverts would encourage organisations to contribute more to remain competitive in the labour market, something we recommended in the CIPD manifesto. Overall, 58% said it would, 22% said it would not, while 20% were unsure.

Despite economic pressures, such as rising employer National Insurance contributions or global trade uncertainty, employer sentiment on the cost implications of proposed pension changes remains stable. The most notable shift is that 35% of respondents now say a 6% employer contribution would significantly increase their wage bill, up from 30% in 2024. Cost concerns are particularly acute in low-wage sectors like retail, so any reforms should be phased in gradually.

The recently announced cap on the maximum that can be contributed to a workplace pension via salary sacrifice hardly helps matters. We are concerned about the implications this poses for HR and reward teams within the 54%* of large firms that currently offer this benefit. This cap will drive up employment costs, while potentially slashing pension contributions and starving British businesses and infrastructure of vital investment. In addition, workers could face a longer road to retirement, again with implications for people management practices, such as performance management and development issues.

While the cap will not be introduced until April 2029, and a lot can happen between now and then, we advise reward and HR professionals to start considering the cost implication of this change for the employer and the steps needed to balance the books. In addition, HR and payroll teams will need this time to make the necessary update to their systems and to communicate this change to employees, especially those earning between £100,000 and £125,000 and use salary sacrifice to avoid the 60% tax effective rate.

Given that most private, and voluntary sector organisations automatically enrol eligible workers into defined contribution schemes. A simple, low-cost, and easy to implement solution is requiring employers to include pension contribution details in job adverts. This would enhance reward transparency and encourage competition for talent. Another cost-effective reform is reducing the minimum automatic enrolment age to 18, phased in over several years for low-wage sectors. This aligns with 18-year-olds becoming eligible for the adult national living wage. We recommend the government consult now on both proposals.

Medium-term changes could include phasing out the LLQE for pensionable pay, while longer-term plans might raise minimum total contributions to 12%. These steps should be subject to consultation in the next few years.

Although, these changes increase employer costs, they also offer benefits: preventing delayed retirements that could strain workforce management and boosting UK investment through workplace pension funds. People professionals and government can offset these additional costs by driving productivity and growth.

For example, HR teams can do this by improving the design of organisations, work, and jobs. The government can achieve this through deregulation and supporting increased productivity, such as by investing in transport and communications. Employees will also contribute more, so additional savings options (such as payroll savings) should be explored to support financial resilience among younger and low-wage workers.

*According to a recent employee benefits survey of 1,059 HR and reward decision-makers working for organisations in the UK and conducted on behalf of the CIPD and Everywhen. Our research will be published early next year and will be discussed at the forthcoming CIPD Employee Benefits Conference in london on 12 March 2026.

Charles has recently led research into the business case for pensions, how front line managers make and communicate reward decisions, and managing reward risks, as well as the creation of a good practice guide on the annual pay review process. He is also responsible for the CIPD’s public policy work in the area of reward and is a Chartered Fellow of the CIPD.

Access the guidance and resources you need to meet the new paternity and unpaid parental leave requirements under the Employment Rights Act 2025

Keep up to date with the latest employment law developments and proposed future changes

This month: Wave of Employment Rights Act 2025 consultations released and what it means for you

Find out what people professionals said about their working lives and career development prospects in our recent pulse survey

As artificial intelligence continues its rapid advancement and becomes the much touted focus for investment and development, we highlight the critical role of the people profession and explain how the CIPD and its members will be involved shaping its impact at work

A look at whether artificial intelligence can cover skills shortages by exploring the benefits of AI and the advantages that can be gained by using generative AI such as ChatGPT

Jon Boys discusses the benefits of generative AI tools, and how organisations can utilise them