Wading through the talent puddle, where money talks

James Cockett analyses findings from CIPD’s Winter 2022/23 Labour Market Outlook, showing hard-to-fill vacancies are rife and are contributing to expected pay rises not seen in over 10 years

James Cockett analyses findings from CIPD’s Winter 2022/23 Labour Market Outlook, showing hard-to-fill vacancies are rife and are contributing to expected pay rises not seen in over 10 years

The CIPD’s Winter 2022/23 Labour Market Outlook report, our quarterly employment barometer dating back to 2012, finds that the median base pay rise expectation among employers has reached 5%. This is a new record high for the survey, however, under a backdrop of the highest inflation in 40 years, this is perhaps unsurprising. Our data shows that the anticipated public sector pay rise expectations of 2% lag those in the private sector at 5%, with the gap providing the context for ongoing discontent and strikes among key public sector workers, as anticipated in my previous Voice article.

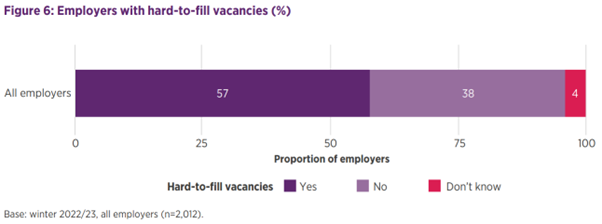

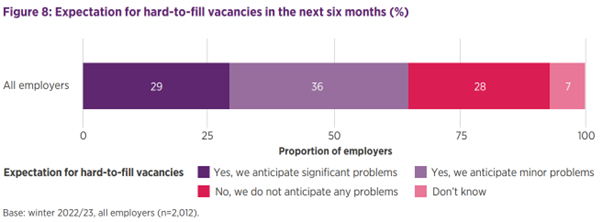

Hiring intentions remain positive, with 38% of employers planning to increase staff levels, and just one in ten (10%) looking to decrease them. Despite this, more than half (57%) of employers said they have hard-to-fill vacancies. With many employers expecting this problem to persist to either a significant (29%) or minor (36%) extent in the next six months.

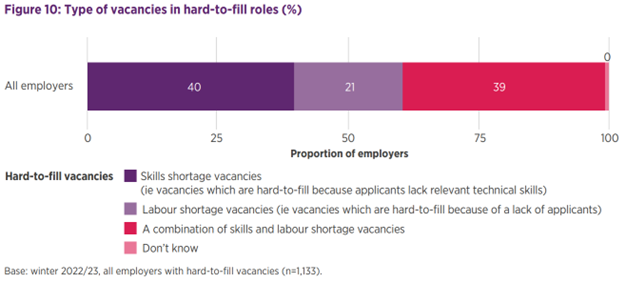

Well, both. Of employers with hard-to-fill vacancies, 40% had skills shortage vacancies, where applicants for advertised roles lack the technical skills required. Twenty-one per cent had labour shortage vacancies, whereby there were a lack of applicants for hard-to-fill roles. Many employers had a combination of skills and labour shortage vacancies (39%). Labour shortages were particularly evident in hospitality (39%) and education (36%).

Just over a quarter of employers said they required employees with the lowest level of qualifications. A similar proportion of employers have indicated a preference for employees with GCSE, A level or higher degree qualifications (and their equivalents). The technical skills of graduates/those with graduate-level qualifications (including higher-level apprentices) are most in demand however, with almost half (47%) of employers with hard-to-fill vacancies requiring employees at this level.

The most common methods used by employers to address hard-to-fill vacancies in the past six months are to upskill existing staff (47%), raise wages (43%) and increase the duties of existing staff (36%). The latter being more prevalent in striking sectors such as education (43%) and healthcare (40%) with those in these sectors pushed to work harder given the lack of new teachers in training and insufficient growth in the medical workforce. This problem won’t go away…

The LMO data shows that employers appear to be more receptive than before to hiring people who are returning to work after having time out of the labour market, for reasons such as caring responsibilities or a health condition. More than a third (36%) plan to do this in the next three years, up from 29% who reported they had done so in the past three years, an important development given the increase in inactivity due to health conditions.

We currently have less of a labour pool, more of a labour puddle, so hiring from groups with barriers to work (and enticing many back into the labour market), many of whom are listed in the figure below, will soon become a necessity rather than a nice to have. To recruit (and retain) these groups job quality, particularly flexibility, has to be high on the agenda with employers having to think creatively and adjust the role to fit the employee, if possible.

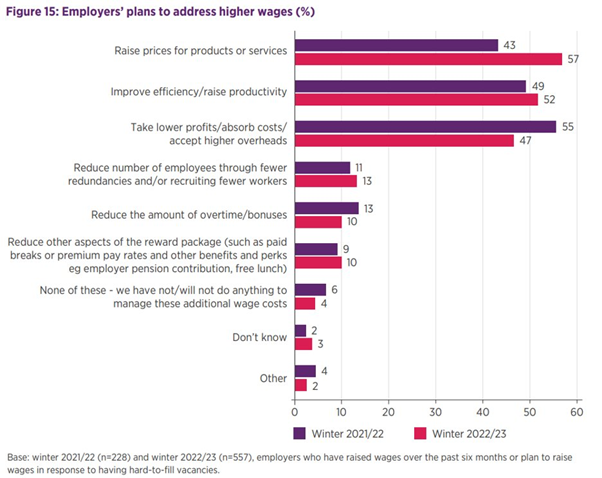

Of those organisations that have or plan to raise pay in response to hard-to-fill vacancies, 57% plan to achieve this by raising prices rather than lowering profits and absorbing costs (47%). The opposite was true 12 months ago (in the Winter 21/22 LMO), suggesting that the tight labour market will increasingly feed through into price rises for organisations’ goods and services. This is something the Bank of England is particularly cautious about as indicated in their February 2023 meeting to discuss interest rate rises.

“[We] will continue to monitor closely indications of persistent inflationary pressures, including the tightness of labour market conditions and the behaviour of wage growth and services inflation. If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.”

In summary, the scramble for talent will continue. The private sector has the lever of raising prices and paying more to recruit and retain, but the Government and the Bank of England want to prevent this spiralling as it risks embedding inflation. The public sector is feeling the pinch. Being asked to work harder to no financial gain is frustrating public sector workers, with the workforce crisis’ not letting up. Employers and Government need to spend more time looking into workforce planning, this starts in a stream perhaps previously unencountered.

Listen to my colleague Jon Boys discuss this quarter’s LMO findings on BBC Radio 4’s Today Programme (from the 23-minute mark): https://www.bbc.co.uk/sounds/play/m001j3gs

Browse our A–Z catalogue of information, guidance and resources covering all aspects of people practice.

Discover our practice guidance and recommendations to tackle bullying and harassment in the workplace.

Dedicated analysis of job quality and its impact on working lives in Scotland

Understanding how your organisation compares can enable you to stay ahead, retain valuable employees, and understand the cost of attrition to your organisation

The CIPD Good Work Index provides an annual snapshot of job quality in the UK, giving insight to drive improvement to working lives

While offering different pay methods could be a boost for employees, we need to ensure there are no unintended consequences

Monthly round-up of changes in employment law in the UK

Research on how an employee's socioeconomic background or class affects their development opportunities and how to maximise social mobility in the workplace

We look at the main focus areas and share practical examples from organisations who are optimising their HR operating model

Ben Willmott explores the new Labour Government strategies to enhance skills and employment to boost economic growth