In the UK, the Low Pay Commission (LPC) is the independent body which advises the UK government on the levels of the National Living Wage (NLW) and National Minimum Wage (NMW). To help shape its recommendations for the 2024 minimum wage rates, in March 2023, the LPC published its annual consultation. The CIPD submitted evidence on the impact of the NLW and NMW on employers, highlighting findings from our summer 2023 Labour Market Outlook.

On this page you can read a summary of the evidence we submitted and download a copy of our full consultation response. The consultation findings inform the recommendations the LPC will make to the Government this autumn. These include the levels of the NMW to be set in April 2024.

"Increasing the national living wage above £11 per hour is reasonable, especially as many firms have so far been able to absorb the extra cost of higher wages. But the UK economy can change rapidly, so this figure should remain under review."

On this page

- Nearly a third of employers report no impact from last year’s increase

- The majority of employers support an increase in the National Living Wage

- Removing the apprenticeship rate would effect few employers

- A more progressive approach to labour market enforcement would boost compliance with National Living Wage regulations

- Download our full response

Nearly a third of employers report no impact from last year’s increase

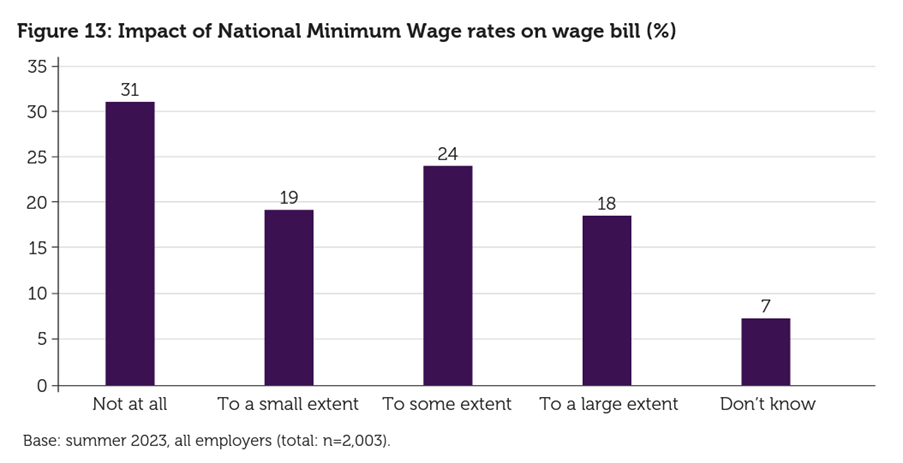

According to the Summer 2023 Labour Market Outlook, 18% of employers said that the rise in the NMW rates in April 2023 had increased their organisation’s wage bill to a large extent, while 24% said the increase had pushed up their wage bill to some extent. A further 19% said the rise had increased their wage bill to a small extent. By contrast, 31% reported no impact following the increase in the Minimum Wage rates.

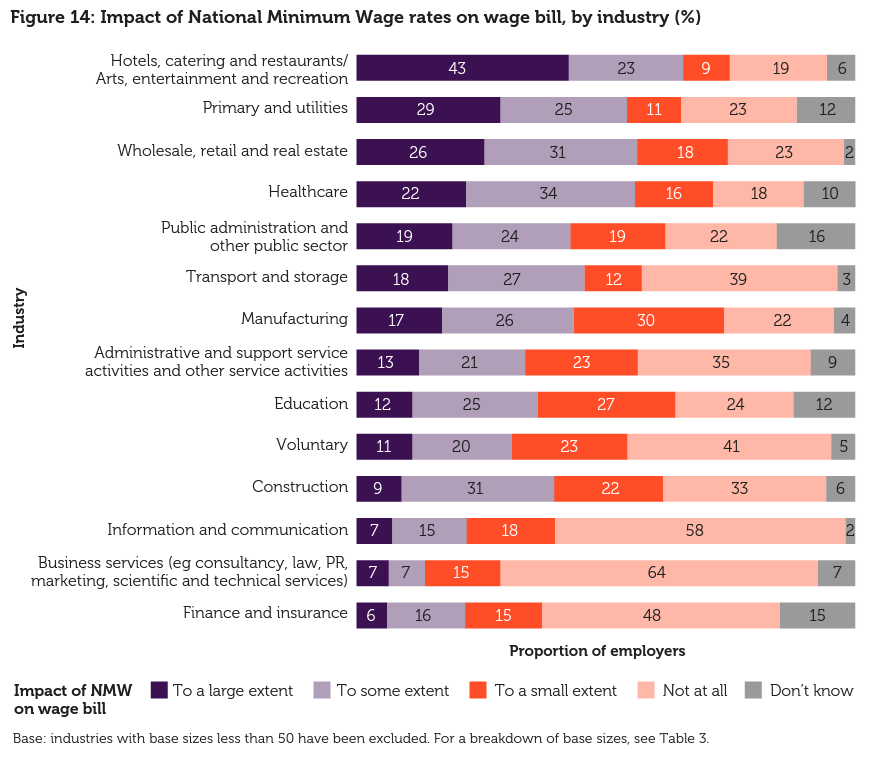

Hospitality, for example, has been disproportionately affected by the increase in the NMW/NLW due to the level of lower-paid workers in the industry, with 43% of employers saying it has impacted their wage bill to a large extent. Two thirds (64%) of employers in business services were not at all affected by the increase in the national minimum wage.

The most common ways organisations are managing the increase in their wage bill are by:

- taking lower profits/absorbed costs/accepted higher overheads (30%);

- raising prices (29%);

- improving efficiency/raising productivity (23%);

- cancelling/scaling down plans for investing in/expanding the business (12%);

- introducing or increasing automation (12%).

To manage the additional wage costs of the NMW, 23% of employers have improved efficiency or raised productivity. There are a variety of ways in which employers have aimed to improve productivity in response to the higher wage bill.

Among those employers most affected by the rise in the Minimum Wage rates, the most common actions to boost productivity include:

- seeking to improve staff morale and motivation (33%);

- requiring staff to take on additional tasks (32%);

- improving general business practices, such as quality control, supply‐chain management, and monitoring of business processes (28%);

- requiring staff to be more flexible in their hours of work (25%).

The majority of employers support an increase in the National Living Wage

When asked what should happen with the NLW rate after April 2024 the most popular approaches among respondents are for it to:

- Keep pace with average wage growth (31%);

- Keep pace with inflation (28%); or

- Increase towards a higher target (such as 70% of median earnings) (10%).

The rest either didn’t know (20%) or supported other policy options (13%), such as focusing on specific rates for sectors or UK regions, or lowering the age eligibility.

Removing the apprenticeship rate would effect few employers

Among the employers surveyed, 43% hire apprentices aged 19 or over. Among these, 10% say that being able to pay the apprentice wage rather than the minimum wage rate for that group, affects their apprentice recruitment decisions to a large extent. Many also believe it affects the recruitment decisions to some extent (22%) or to a small extent (17%).

30% of employers whose wage bill have been impacted by a large extent because of NLW changes in 2023 say being able to pay the apprentice rate affects their recruitment decisions on apprentices to a large extent.

Overall, removing the apprenticeship rate would impact around one-third of employers that hire apprentices to a large or significant extent. By contrast, this move would either have a small or no impact for over half of employers that recruit apprentices.

A more progressive approach to labour market enforcement would boost compliance with National Living Wage regulations

To comply with National Minimum Wage/ National Living Wage regulations, employers take a series of actions:

- Build compliance into payroll system (i.e. it’s not possible to pay below the current rates) (39%);

- Pay above the NMW rates to reduce the risk of underpayment (25%);

- Conduct an annual audit of minimum wage compliance (23%);

- Check Gov.uk website (19%); and

- Review payroll record keeping (15%).

While it’s right that employers deliberately flouting the minimum wage law are fined for doing so, these regulations can be complex and some organisations might break the law inadvertently because of a lack of resources or expertise, especially small firms.

That’s why the CIPD supports the sharing of examples of how mistakes have happened in the past so that they can be avoided in the future. We also believe there should be more support to boost employer compliance, particularly for SMEs as part of a more progressive approach to labour market enforcement.

Read our full response

CIPD response to the 2023 Low Pay Commission Consultation

Influencing policy

Our public policy team champions better work and working lives by shaping public debate, government policy and legislation.